Sales Tax Rate For Jacksonville Fl – Buyers can often filter search results by price, condition, and location, making it easier to find the best deals. The idea of being “for sale” also touches on larger cultural and societal themes. A piece of art, for example, may be valued differently by various individuals based on personal taste, financial resources, or the emotional connection they feel to the work. To mitigate this risk, buyers should ask for detailed photos, read product descriptions carefully, and inquire about the condition of the item before making a purchase. For environmentally conscious consumers, buying second-hand is not just a cost-effective choice, but a way to make a positive contribution to the planet. Additionally, second-hand furniture allows buyers to find unique items that may not be available in traditional furniture stores. When someone buys a second-hand item, whether it’s a piece of furniture passed down through generations or a retro jacket from a bygone era, they are not just acquiring an object; they are connecting to a story, a memory, or a cultural moment. Online platforms also give buyers and sellers the chance to evaluate one another through reviews and ratings, adding an extra layer of trust and security to the transaction. The business-for-sale market continues to evolve, influenced by economic trends, technological advancements, and shifts in consumer behavior, but one thing remains clear: buying and selling businesses will always be a fundamental part of the global economy. These professionals help connect buyers with sellers, ensuring that both parties are well-informed and that the transaction process is as smooth as possible. A high-quality winter coat, for example, will keep you warm and dry through years of cold weather, offering comfort and protection that a cheaper, mass-produced coat cannot match. This has opened up new opportunities for small businesses to thrive and for consumers to access unique, well-made items that they might not have encountered otherwise. These platforms have also made it easier for individuals to sell their own pre-owned goods, turning unused or unwanted items into cash. The very notion that everything can be bought and sold creates a society where inequality is not just accepted, but ingrained in the very structure of the economy. Love becomes about what someone can provide in terms of material or emotional benefit, and friendships become alliances, where loyalty is traded for favor or influence. Yet, despite this shift, the appeal of quality craftsmanship has not waned. When a car is put up for sale, it can feel like letting go of a part of one’s journey. Some businesses are sold because the owner is ready to retire, while others might be sold due to financial difficulties or changes in the owner’s personal or professional life. The internet, for example, has created a space where anyone can buy or sell almost anything, from physical products to intangible services. Through online marketplaces and platforms, small businesses and independent creators can sell their goods to a global audience.

An Overview of Florida Sales Taxes for Businesses

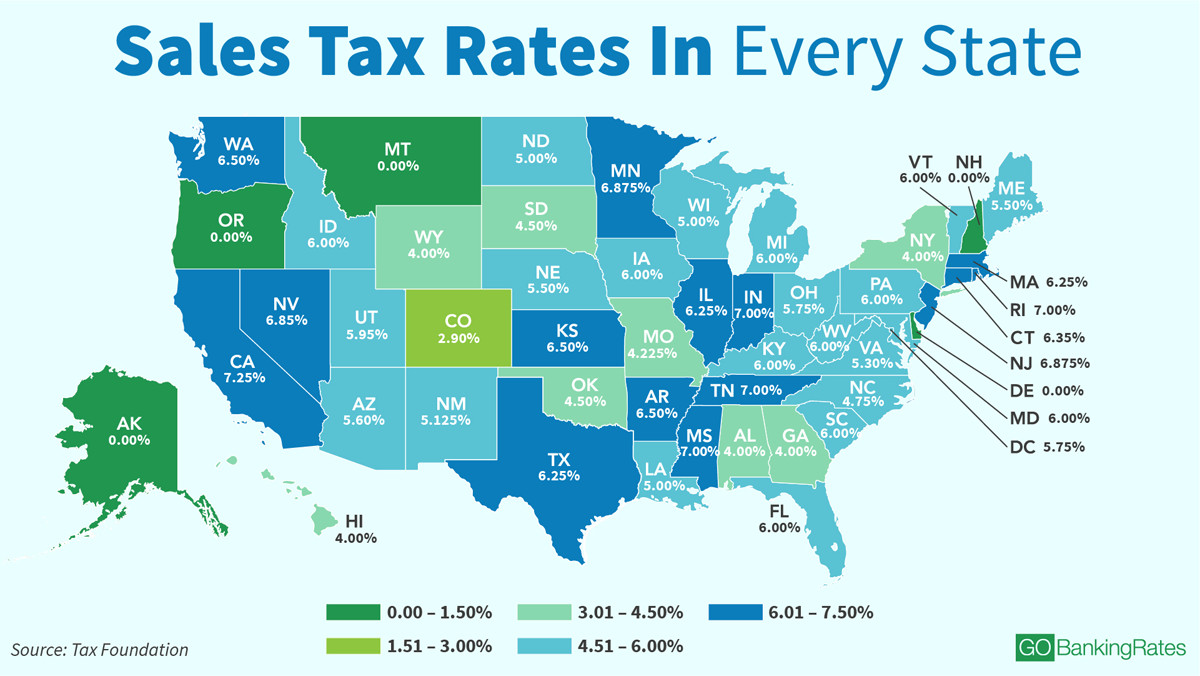

Simply enter an amount into our calculator above to estimate how much sales tax you'll likely see in duval county, florida. The current total local sales tax rate in duval county, fl is 7.500%. Sales tax calculator to help you calculate tax amount and total amount. Afterwards, hit calculate and projected results will then be shown. What is the sales.

Ayana Lapointe

What is the sales tax in jacksonville? This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for jacksonville, florida is 7.5%. 166.231, and chapters 790 and 792 of the city of jacksonville municipal ordinance code, as amended and supplemented for the. Look up 2024 florida sales tax rates in an.

Florida Sales Tax Small Business Guide TRUiC

The 32256, jacksonville, florida, general sales tax rate is 7.5%. There is no applicable city tax or special tax. The latest sales tax rate for duval county, fl. In florida, the sales tax rate is composed of three different rates: Jacksonville sales tax rate is 7.50% the total sales tax rate in jacksonville comprises the florida state tax, and the.

What is the Sales Tax Rate in Jacksonville Florida?

The current total local sales tax rate in duval county, fl is 7.500%. What is duval county sales tax? Some counties can also impose additional sales tax,. Afterwards, hit calculate and projected results will then be shown. These figures are the sum of the rates together on the state, county, city,.

Jacksonville Fl Sales Tax Rate 2024 Josey Mallory

It gives you taxable amount, tax and total amount in jacksonville. This is the total of state, county, and city sales tax rates. The city does not impose an additional sales tax. The december 2020 total local sales tax rate was 7.000%. Afterwards, hit calculate and projected results will then be shown.

Florida Sales Tax Free Days 2024 Idell Lavinia

Sales tax rates in duval county are determined by five different tax jurisdictions, atlantic beach, baldwin, jacksonville, jacksonville beach and saint johns. The local sales tax rate in duval. In florida, the sales tax rate is composed of three different rates: Free sales tax calculator tool to estimate total amounts. Simply enter an amount into our calculator above to estimate.

jacksonville fl sales tax rate 2019 Struck Gold Newsletter Photographs

There is no applicable city tax or special tax. Look up 2024 florida sales tax rates in an easy to navigate table listed by county and city. The current sales tax rate in jacksonville, fl is 7%. The current sales tax rate in 32216, fl is 7.5%. It gives you taxable amount, tax and total amount in jacksonville.

Florida Sales Tax Calculator

There is no applicable city tax or special tax. 166.231, and chapters 790 and 792 of the city of jacksonville municipal ordinance code, as amended and supplemented for the. Jacksonville has a combined sales tax rate of 7.50%. The december 2020 total local sales tax rate was 7.000%. The 7.5% sales tax rate in jacksonville consists of 6% florida state.

What is the Sales Tax Rate in Jacksonville Florida?

What is the sales tax in jacksonville? The average cumulative sales tax rate in jacksonville, florida is 7.48% with a range that spans from 6.5% to 7.5%. You can print a 7.5% sales tax. There is no applicable city tax or special tax. The city does not impose an additional sales tax.

.png)

Florida Sales Tax Schedule 2024 Bobina Melisa

This is usually the combined state and county sales tax. This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for jacksonville, florida is 7.5%. The combined rate used in this calculator (7.5%) is the result of the florida state rate (6%), the 32256's county rate (1.5%). You can print a.

The truth is that the idea of quality is deeply rooted in the philosophy of craftsmanship, heritage, and trust, which explains why certain items, often categorized as quality goods, tend to be prized more than others, even when they may come with a higher price tag. The rise of online platforms has transformed the way second-hand goods are bought and sold. With just a few clicks, consumers can browse through thousands of listings for second-hand items from all over the world. This revival can be attributed to a combination of economic factors, growing awareness of environmental issues, and a shift in consumer attitudes toward sustainability and the value of pre-owned items. It forces us to ask difficult questions about ownership, worth, and the limits of human desire. What was once limited to boutique shops or high-end department stores can now be purchased from the comfort of one’s home. The same logic applies to tools, kitchen appliances, furniture, and even technology. In a world dominated by fast fashion, disposable electronics, and mass-produced items, many people are beginning to question the value of constantly purchasing new products. In many cases, sellers may work with business brokers, financial advisors, or accountants to help value the business and identify potential buyers. But in reality, even the most profound relationships can be commodified in some way. A car might be sold because it no longer serves the needs of its owner, or perhaps the owner is simply ready for a change. Cars, too, are often sold with a sense of transition. In this broader sense, the concept of “for sale” is not just about the exchange of goods; it’s a driving force in the global economy, influencing how people live, work, and interact with the world around them. Quality goods stand in stark contrast to this cycle. This creative process not only gives new life to old objects but also encourages people to think outside the box when it comes to the things they buy and use. Sellers also have to deal with the emotional aspects of letting go of a business that they may have built over many years. Many quality goods are made by artisans or small businesses who take the time to create products that reflect their expertise and passion. In conclusion, second-hand goods for sale represent more than just a financial transaction; they embody a shift toward sustainability, individuality, and social responsibility. This has made it easier for people to find items that might have otherwise been out of reach, whether it’s a rare collectible, an antique, or a product from another country. The role of business brokers and intermediaries has become increasingly important in today’s business-for-sale market.

A well-made frying pan or a durable pair of boots might not have the cachet of a designer handbag, but their value lies in their functionality and reliability. One common concern is the risk of purchasing items that are damaged or not as described. Some need the money, some want to declutter, and others might feel the urge to let go of possessions as they enter new phases in their lives. These platforms allow users to browse listings, communicate with sellers, and make purchases from the comfort of their own homes. The first and most obvious reason is the tangible benefits they offer. Self-help books and motivational speakers promise to sell us the tools to fix ourselves, to buy into a better version of who we could be. Unlike mass-produced items that may become outdated or fall apart with minimal use, quality products are designed to endure. For when everything is for sale, it’s easy to forget that the most important things in life are not commodities; they are experiences, relationships, and moments of connection that cannot be measured in dollars and cents. Take, for example, a high-quality piece of furniture — a well-crafted sofa or dining table can last for decades if maintained properly. For those who are passionate about antiques, art, and memorabilia, the second-hand market offers endless possibilities for finding unique and valuable items that can be passed down through generations or added to a collection. This has made it easier for people to find items that might have otherwise been out of reach, whether it’s a rare collectible, an antique, or a product from another country. This desire for items with character and a story behind them has contributed to the growing appeal of second-hand goods. Each item was unique, and the quality was immediately apparent to the buyer. For those considering buying a business, the appeal often lies in the opportunity to take over an existing operation and build upon its foundation. Social movements and grassroots organizations work tirelessly to provide resources and support to those who need it, often without expecting anything in return. The closing process also involves transferring the business’s assets, such as inventory, property, intellectual property, and customer contracts, to the new owner. Second-hand goods, especially those that are vintage or antique, often carry a sense of history and craftsmanship that can be missing from mass-produced products. It implies that there’s nothing off-limits, nothing beyond the reach of commerce. The idea that everything has a price, and that everything is for sale, may seem like a grim outlook, but it’s one that has become increasingly true. Additionally, brick-and-mortar thrift stores and consignment shops provide a more traditional avenue for selling second-hand goods.