Sales Tax For Everett Washington – The buying and selling of companies, brands, and even entire industries can reshape economies, alter job markets, and redefine how goods and services are delivered. Despite the many advantages of buying and selling second-hand goods, there are some challenges that both buyers and sellers must navigate. By purchasing second-hand goods, consumers help keep products circulating in the economy, giving them new life and purpose. For buyers, the process typically starts with identifying a business that aligns with their interests, skills, and goals. Their inherent value comes not only from their physical characteristics but also from the values of durability and sustainability. Due diligence is a crucial part of the process, where the buyer investigates the business thoroughly to ensure that there are no hidden liabilities, potential risks, or operational inefficiencies. Thrift stores, estate sales, and online marketplaces are excellent places to find second-hand furniture, with options ranging from antique and vintage pieces to more contemporary items. It is also important to check the seller’s reputation and read reviews or feedback from previous buyers. The resale of pre-owned clothing has become a booming industry in recent years, with second-hand stores and online marketplaces thriving as more consumers opt for affordable, sustainable alternatives to fast fashion. Many brokers specialize in certain industries or types of businesses, allowing them to better serve their clients by offering specialized knowledge and advice. It involves an in-depth understanding of the business’s financials, operations, and market position. In a world where everything is for sale, it’s easy for the vulnerable and the marginalized to be taken advantage of. In some cases, selling second-hand items can be a way to make a significant profit, especially if the items are rare, vintage, or in high demand. Quality goods transcend trends and fleeting fads. Whether it’s the sleek lines of a designer chair or the intricate patterns on a handwoven rug, quality goods are often as much about aesthetics as they are about functionality. When an item is marked as “for sale,” it enters a space where value is defined not only by the object itself but by the context in which it’s placed. Selling such an item can be a difficult decision, yet it often represents the practical need to downsize or make space for something new. This revival can be attributed to a combination of economic factors, growing awareness of environmental issues, and a shift in consumer attitudes toward sustainability and the value of pre-owned items. The democratization of commerce has opened up opportunities for millions of people, giving them the chance to pursue their dreams and create their own paths to success. For the seller, the goal is to achieve the highest price possible for the business, while for the buyer, the goal is often to secure a fair price that reflects the true value of the business.

sales tax everett wa 2021 Code Vlog Slideshow

512 95th ct se, everett, wa 98208 is a 3 bed, 1 / 2 bath, 1,714 sqft townhouse in cascade view, everett, washington and is currently listed for sale at $585,000 with mls. With local taxes, the total sales tax rate is between 7.000% and 10.500%. The state sales tax rate in washington is 6.500%. Get information about ifta licenses,.

Onita Duran

The current total local sales tax rate in everett, wa is 9.800%. The sales and use tax is washington’s principal revenue source. Get information about ifta licenses, tax returns, and recordkeeping requirements for carriers operating in more than 1 state or province. Search by address, zip plus four, or use the map to find the rate for a specific location..

washington state sales tax everett wa Lakisha Dent

The 98204, everett, washington, general sales tax rate is 10.5%. Get information about ifta licenses, tax returns, and recordkeeping requirements for carriers operating in more than 1 state or province. The combined rate used in this calculator (10.5%) is the result of the washington state rate (6.5%), and in some case, special. The state sales tax rate in washington is.

Ultimate Washington Sales Tax Guide Zamp

There is also 1 out of 8 zip codes in everett that are. The total sales tax rate in everett comprises the washington state tax, and the city which imposes an additional sales tax of 3.40%. To calculate sales and use tax only. The current sales tax rate in 98201, wa is 9.9%. You’ll find rates for sales and use.

80K S.W. Everett, WA Area Tax Practice For Sale ABA Advisors, LLC

The calculator will show you the total sales tax amount, as well as the. Washington has recent rate changes (thu jul 01 2021). The current sales tax rate in 98201, wa is 9.9%. Everett, wa is in snohomish county. You’ll find rates for sales and use tax, motor vehicle taxes, and lodging tax.

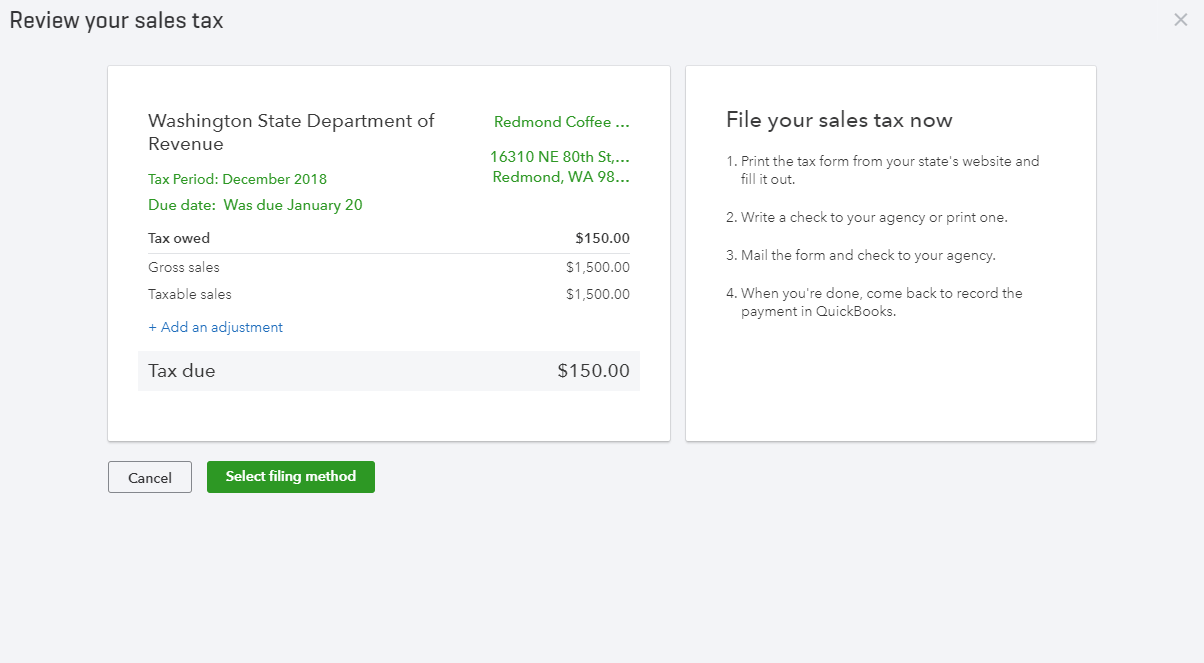

How to Record Washington State Sales Tax in QuickBooks Online

Everett sales tax rate is 9.90%. You can print a 9.9% sales tax table here. The washington sales tax rate is currently 6.5%. The 98204, everett, washington, general sales tax rate is 10.5%. The 9.9% sales tax rate in everett consists of 6.5% washington state sales tax and 3.4% everett tax.

sales tax everett wa 2021 Code Vlog Slideshow

The current total local sales tax rate in everett, wa is 9.800%. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. The minimum combined 2025 sales tax rate for everett, washington is 9.9%. This is the total of state, county, and city sales tax rates. The current sales tax rate in.

Washington Sales Tax Calculator and Local Rates 2021 Wise

The 98204, everett, washington, general sales tax rate is 10.5%. 535 rows combined with the state sales tax, the highest sales tax rate in washington is. Get ifta information return to top The combined rate used in this calculator (9.9%) is the result of the washington state rate (6.5%), the everett tax rate (3.4%). The minimum combined 2025 sales tax.

sales tax everett wa 2021 Code Vlog Slideshow

Everett sales tax rate is 9.90%. The total sales tax rate in everett comprises the washington state tax, and the city which imposes an additional sales tax of 3.40%. The 98204, everett, washington, general sales tax rate is 10.5%. This is the total of state, county, and city sales tax rates. The current sales tax rate in 98201, wa is.

Everett, Washington Sales Tax Rate Sales Taxes By City January 2025

The current sales tax rate in 98201, wa is 9.9%. The calculator will show you the total sales tax amount, as well as the. The minimum combined 2025 sales tax rate for everett, washington is 9.9%. Everett has 7 zip codes out of 8 zip codes subject to city sales tax, meaning 87.5% of the city is covered under its.

The culture of buying second-hand goods is rapidly shifting in the modern world, particularly among younger generations. It carries the marks of life’s moments: the road trips, the adventures, the daily commutes, the memories of friends and family. Websites like eBay, Craigslist, Facebook Marketplace, and Poshmark have made it easier than ever for individuals to sell their unwanted items and for buyers to find exactly what they are looking for. Thrifted clothing, vintage furniture, and pre-owned electronics are often seen as more authentic and unique than brand-new, mass-produced items. In this sense, purchasing pre-owned items can be seen as a form of social responsibility, as it helps create a positive impact that extends beyond the individual buyer. For some, selling something may feel like a sacrifice, while for others, it may feel like an investment in their future. For those considering buying a business, the appeal often lies in the opportunity to take over an existing operation and build upon its foundation. Social media platforms, for example, offer users a chance to buy into their own identity, to curate a version of themselves that is more appealing, more desirable, more marketable. The items placed for sale are not merely commodities; they are often vessels of memories, symbols of past achievements, or representations of something bigger than the price tag they carry. Quality goods stand in stark contrast to this cycle. Brokers are well-versed in valuation, marketing, negotiation, and closing procedures, which makes them invaluable assets in the business-for-sale process. These moments remind us that there is more to life than the pursuit of profit, and that not everything can be measured by a price tag. By purchasing second-hand goods, consumers help keep products circulating in the economy, giving them new life and purpose. The object becomes more than just an object – it transforms into a transaction, an exchange of value. The practice of buying and selling second-hand items has been around for centuries, but in recent years, it has seen a resurgence. While buying and selling second-hand items can come with its challenges, the rewards—both financially and environmentally—make it a worthwhile pursuit for many people. Another aspect that contributes to the appeal of quality goods for sale is the level of detail and attention given to the design. In many cases, sellers may work with business brokers, financial advisors, or accountants to help value the business and identify potential buyers. While there are certainly markets where affordable goods are a necessity, quality goods for sale often come with a premium price tag. For instance, when someone is job hunting, it can feel like they’re placing themselves on the market, waiting for the right offer.

Whether you’re the seller or the buyer, the phrase “for sale” is a reminder that everything in life is in constant motion, always moving toward something new, something different, something better. In this digital age, it often feels like there’s no such thing as privacy anymore, and that’s because we’ve essentially agreed to sell pieces of ourselves in exchange for recognition, affirmation, or even money. Thrift stores often carry a wide variety of goods, from clothing and accessories to furniture, books, and electronics, and each item comes with its own story. Legal experts are often involved at this stage to ensure that the transaction is conducted in compliance with all relevant laws and regulations. Historically, many products were made by local craftsmen, and there was a direct relationship between the creator and the consumer. The rise of online platforms dedicated to the sale of second-hand goods has also played a significant role in the growing popularity of pre-owned items. It’s a moment of transition, and as with all transitions, it brings with it both excitement and uncertainty. The culture of buying second-hand goods is rapidly shifting in the modern world, particularly among younger generations. The object becomes more than just an object – it transforms into a transaction, an exchange of value. For those who enjoy the tactile experience of shopping and the sense of discovery that comes with it, thrift stores offer a personal and immersive way to shop for second-hand items. Quality goods stand in stark contrast to this cycle. After the sale is complete, the buyer assumes responsibility for the business and takes control of its day-to-day operations. The struggle is not in resisting the marketplace entirely, but in finding balance, in ensuring that the things that truly matter cannot be bought, sold, or traded. Moreover, buying second-hand items allows consumers to access unique and vintage products that may no longer be available in stores, offering a sense of individuality that is often missing from mass-produced, new items. For sellers, the market for second-hand goods offers an opportunity to declutter their homes and make some extra money. On the other hand, buyers may seek to negotiate lower terms based on the findings from their due diligence or their assessment of the business’s future potential. Second-hand items are typically sold for a fraction of their original price, making them an attractive option for individuals on a budget. Once an agreement is reached, the final step is the legal transfer of ownership. To mitigate this risk, buyers should ask for detailed photos, read product descriptions carefully, and inquire about the condition of the item before making a purchase. This connection between consumers and the creators of quality goods is something that’s been fostered for centuries.